UNDERSTANDING BITCOIN BASICS AND BEYOND

BITCOIN BASICS

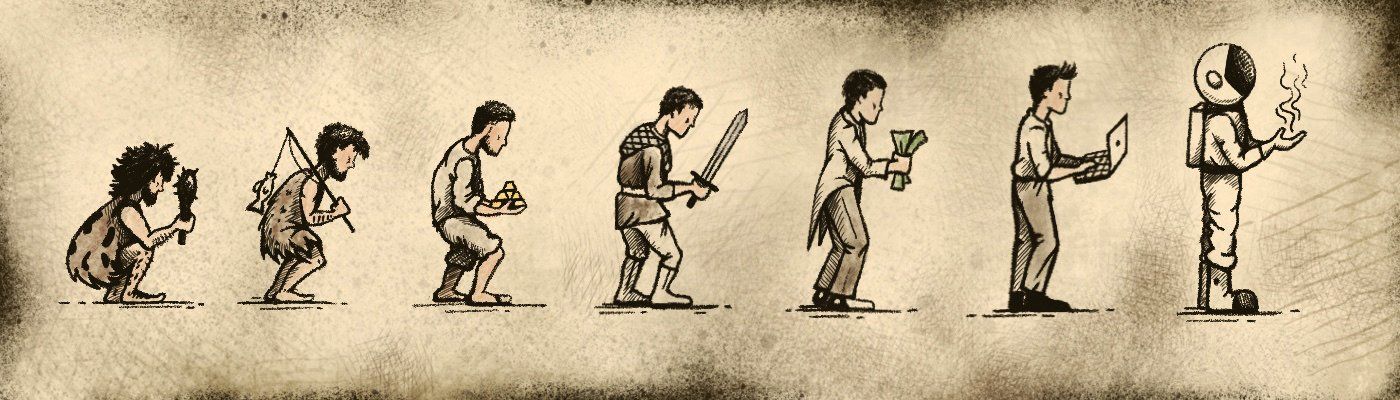

Bitcoin is a revolutionary digital currency that cuts out the middleman, using blockchain technology to enable fast, secure, peer-to-peer transactions. Whether you're looking to invest or make purchases, Bitcoin offers a new frontier in global finance.

HOW BITCOIN WORKS

Bitcoin runs on blockchain technology, a decentralized ledger that records every transaction across a global network of computers. Miners verify transactions by solving complex puzzles, securing the network and earning Bitcoin in return. This peer-to-peer system allows for fast, secure transfers without needing banks or intermediaries.

SECURITY

Bitcoin uses advanced cryptography to ensure secure transactions, with private keys protecting ownership. Storing Bitcoin safely involves using secure wallets, enabling two-factor authentication, and staying vigilant against phishing and scams. With proper precautions, Bitcoin offers a highly secure way to manage digital assets.

MARKET TRENDS

With a capped supply of only 21 million Bitcoin, scarcity drives its value. Every four years, the "halving" event occurs after 210,000 blocks, reducing the reward for miners and limiting new Bitcoin entering circulation. This event often triggers price increases due to reduced supply, making halving a key factor in Bitcoin’s market dynamics.

FEATURED ARTICLES

Top Bitcoin Educational Articles

Bitcoin Glossary

Address: A unique string of letters and numbers that represents the destination for a Bitcoin payment. It’s similar to a bank account number in traditional finance.

Algorithm: A set of rules or processes followed in calculations. Bitcoin uses the SHA-256 cryptographic algorithm to secure transactions and create new blocks in the blockchain.

Altcoin: Any cryptocurrency other than Bitcoin. Examples include Ethereum, Litecoin, and Ripple.

Blockchain: A decentralized, distributed ledger that records all Bitcoin transactions. It consists of blocks linked together in chronological order, secured by cryptography.

Block: A group of transactions added to the blockchain. Each block contains a record of recent Bitcoin transactions, a timestamp, and a reference to the previous block.

Block Reward: The Bitcoin awarded to miners for successfully validating a block of transactions and adding it to the blockchain. The reward halves approximately every four years in a process called halving.

Cold Wallet: A Bitcoin wallet that is stored offline, often in the form of a hardware wallet or paper wallet, making it more secure from hacking.

Cryptography: The practice of securing information by converting it into a code, which is used in Bitcoin to secure transactions and wallet ownership.

Decentralization: The principle of distributing power away from a central authority. Bitcoin operates on a decentralized network of computers, meaning no single entity controls the system.

Halving: An event that occurs every 210,000 blocks (approximately every four years) where the reward for mining Bitcoin is reduced by half, limiting the number of new Bitcoin entering circulation.

Hash Rate: The measure of computational power used to mine Bitcoin. A higher hash rate increases the chance of validating a block and receiving a reward.

Hot Wallet: A Bitcoin wallet that is connected to the internet, used for everyday transactions. It is more convenient but also more vulnerable to hacking compared to cold wallets.

Keys (Private & Public):

- Private Key: A secret alphanumeric code that allows access to your Bitcoin and must be kept secure.

- Public Key: A cryptographic code used to receive Bitcoin, which is shared with others as part of an address.

Mining: The process by which transactions are verified and added to the blockchain. Miners use computational power to solve complex mathematical problems, earning Bitcoin as a reward.

Node: A computer that connects to the Bitcoin network and helps verify transactions and maintain the blockchain. There are full nodes, which store the entire blockchain, and light nodes, which store parts of it.

Peer-to-Peer (P2P): A decentralized network where participants interact directly without intermediaries. Bitcoin transactions happen directly between users on the P2P network.

Proof of Work (PoW): The consensus mechanism used in Bitcoin where miners solve complex problems to validate transactions and secure the network.

Satoshi: The smallest unit of Bitcoin, equivalent to 0.00000001 BTC. Named after Bitcoin’s creator, Satoshi Nakamoto.

Satoshi Nakamoto: The pseudonymous person or group who created Bitcoin and published the original Bitcoin whitepaper in 2008.

Smart Contract: A self-executing contract with the terms of the agreement written directly into code. Though Bitcoin is primarily used as digital currency, some other blockchains like Ethereum focus more on smart contracts.

Wallet: A digital tool used to store, send, and receive Bitcoin. There are various types of wallets, including hot and cold wallets, as well as software and hardware wallets.

Whale: An individual or organization that holds a large amount of Bitcoin, capable of influencing the market with large trades or transfers.

Consensus: The agreement between network participants on the validity of transactions and the state of the blockchain.

Fiat Currency: Government-issued currency like the US Dollar or Euro, which contrasts with cryptocurrencies like Bitcoin.